How to Prevent Self-Referral Fraud in Your Shopify Store’s Referral Program

Referral programs are one of the most effective customer acquisition channels for Shopify merchants. According to recent e-commerce data, referral customers have a 25% higher lifetime value than other acquired segments. But here’s the problem: self-referral fraud is quietly eroding margins and program integrity across thousands of stores.

Self-referral fraud occurs when a customer manipulates your referral program by creating multiple accounts, using variant email addresses, or generating referrals to themselves to claim unearned rewards. It’s not a rare edge case—Shopify merchants report fraud rates between 5–15% of all referral activity on programs without proper controls.

The damage extends beyond lost reward dollars. Fraudulent activity skews your referral analytics, wastes time on manual review, and erodes trust in your loyalty infrastructure. More critically, it signals to legitimate advocates that the program isn’t properly managed, discouraging genuine participation.

The good news? Self-referral fraud is preventable with the right combination of verification layers, technology, monitoring, and policy clarity. This guide provides a practical, step-by-step framework to protect your Shopify referral program from abuse while maintaining a frictionless experience for honest customers.

>> You may also like:

- Shopify Referral Traffic: What It Is and How to Generate More Sales

- What Is Referral Spam And How To Protect Your Shopify Store Data

Understanding Self-Referral Fraud & Its Risks

What Is Self-Referral Fraud?

Self-referral fraud in e-commerce occurs when an individual exploits a referral program’s mechanics to claim rewards without generating legitimate referrals. Unlike typical fraud, self-referral fraud doesn’t involve external bad actors—it’s perpetrated by program participants themselves or coordinated groups using the same household, device, or payment method.

Common examples:

- A customer creates two accounts and generates a referral from “Account A” to “Account B” to claim the reward

- A user exploits email variants (firstname+1@gmail.com, firstname+2@gmail.com) to appear as different customers

- Multiple accounts share the same shipping address, payment method, or device fingerprint while generating high-volume referrals

- A fraudster uses VPNs or proxy services to mask their true IP address and create the appearance of geographically diverse referrals

Why Shopify Stores Are Vulnerable

Shopify’s ease of store creation and liberal account policies make referral programs attractive targets. Unlike marketplaces with centralized identity verification, individual Shopify stores often lack:

- Mandatory identity verification at signup

- Cross-account linking detection across different browsers or devices

- Payment validation beyond basic credit card processing

- Sophisticated behavioral analytics to flag anomalies in real-time

This openness is one of Shopify’s strengths for legitimate merchants, but it creates gaps that fraudsters exploit.

The Business Impact of Self-Referral Fraud

The consequences of uncontrolled self-referral fraud extend across your entire operation:

- Margin erosion: Fraudulent rewards reduce profitability. A store offering $20 per referral could lose $300–$500 monthly to a single coordinated fraudster generating 15–25 fake referrals.

- Data corruption: Inflated referral metrics obscure true program performance, making it impossible to optimize campaigns or identify genuine high-value advocates.

- Customer trust damage: Legitimate referrers notice when rewards dry up or become harder to claim, assuming the program is broken or unfair.

- Chargeback risk: Some fraudsters don’t stop at referral rewards—they escalate to payment fraud, triggering chargebacks and damaging your merchant account standing.

- Operational overhead: Manual audits and dispute resolution consume staff resources that could focus on growth.

Common Tactics Used in Self-Referral Fraud

Understanding how fraudsters operate is your first line of defense. Here are the most prevalent tactics:

Multiple Account Creation from Same Device/IP

Fraudsters create several customer accounts from a single device or IP address, then cross-reference them to generate qualifying referrals. This is the single most common self-referral tactic.

Red flags:

- Multiple accounts registered within hours or days from the same IP

- Identical device fingerprints (browser, OS, screen resolution, plugins)

- Same household IP address shared by multiple accounts

Email Variant Exploitation

Email services like Gmail allow the “+” syntax: firstname+1@gmail.com, firstname+2@gmail.com all route to firstname@gmail.com. Fraudsters exploit this to bypass duplicate email detection.

Example: A fraudster uses john+1@gmail.com and john+2@gmail.com to create two separate accounts that appear unrelated but funnel to the same inbox.

Cross-Use of Payment Methods & Shipping Addresses

Multiple accounts linked to:

- The same credit card or payment processor account

- The same shipping address (or very close geographic clusters)

- The same phone number

- The same billing ZIP code combined with unique names

Abnormally Fast or High Referral Conversions

Legitimate referral conversions take time—days or weeks as referred customers browse, decide, and purchase. Fraudulent conversions often show:

- Instant or near-instant referral confirmation (within minutes of signup)

- Disproportionately high conversion rates (90%+ vs. industry average of 5–15%)

- Clustering of multiple conversions in a single hour from different accounts

Referral Links Circulated in Closed/Private Channels

Fraudsters share referral links in private Discord servers, Reddit communities, or Telegram groups specifically organized to game loyalty programs. These coordinated rings amplify the fraud at scale.

Essential Prevention Strategies & Best Practices

Multi-Layer Verification and Validation

1. Email and Phone Verification

Require confirmed email addresses for both the referrer (advocate) and the referred customer before any reward is issued. Phone verification adds a second authentication layer and makes it significantly harder for a single fraudster to create multiple accounts.

- Implement email double-opt-in before account activation

- Require SMS verification for referral eligibility (optional but highly effective)

- Flag accounts using temporary/disposable email services (platforms like 10minutemail, Temp Mail)

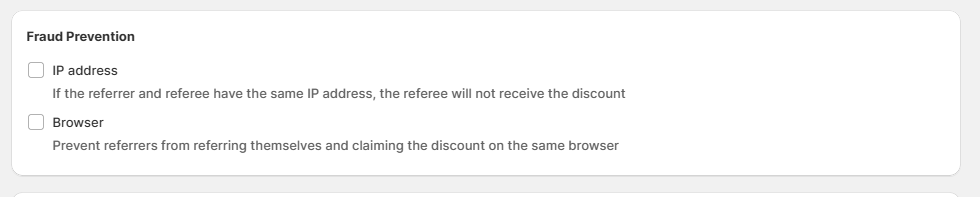

2. IP Address & Device Fingerprinting

Track the IP addresses and device attributes (browser type, OS, screen resolution, installed fonts, etc.) associated with each account. This allows you to:

- Detect when multiple accounts originate from the same IP

- Flag VPN or proxy usage (common fraud indicator)

- Identify coordinated fraud rings operating from the same location

- Cross-reference historical patterns

Tools like MaxMind or Fraudlogix provide IP geolocation and proxy detection. Device fingerprinting libraries (e.g., FingerprintJS) capture detailed browser signatures.

3. CAPTCHA and Manual Challenges

Implement CAPTCHA (or reCAPTCHA v3) on referral signup and reward claims, especially when:

- Multiple accounts are detected from the same IP

- An account attempts to claim more than one reward per day

- Unusual geographic inconsistencies appear (e.g., IP location shifts dramatically between sign-up and purchase)

Manual challenges (e.g., “Please confirm your referral by clicking a unique link sent to your email”) add friction but catch sophisticated bots.

4. Payment Information Cross-Check

Before awarding a reward, verify:

- The billing address matches the account registration address

- The payment method hasn’t been linked to multiple reward claims in a short time

- The cardholder name aligns with the account holder’s name

Transaction Controls & Throttling

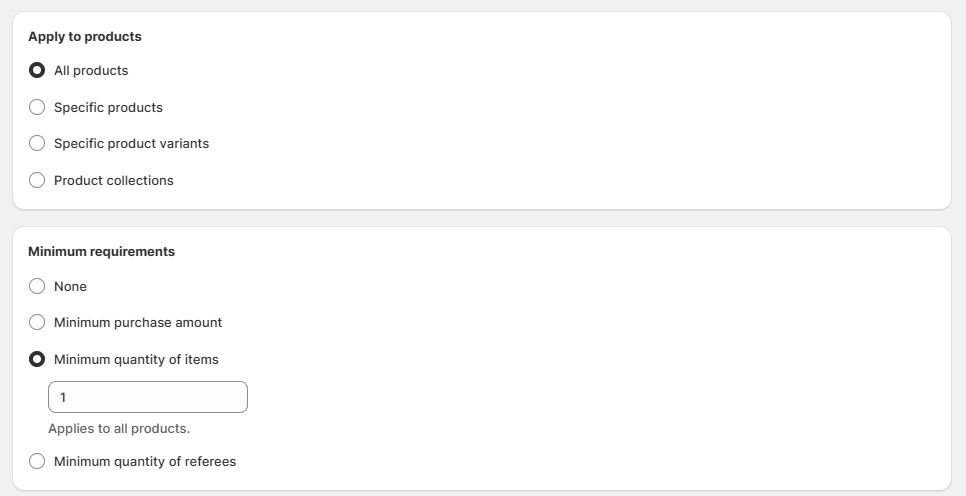

Reward Caps

Limit the maximum referral rewards a single account can earn:

- Per-period caps: Maximum $100 per account per month, or 5 referral rewards per month

- Lifetime caps: Maximum $500 per account lifetime

- Daily throttling: No more than 1 reward per account per day

These limits don’t affect legitimate advocates but stop fraudsters from rapid-fire abuse.

Fulfillment-Based Reward Issuance

Never issue rewards immediately. Instead:

- Award rewards only after the referred order is fulfilled (shipped and delivered)

- Withhold rewards if the referred order is cancelled or refunded

- Implement a 7–14 day hold period post-fulfillment before rewards are credited to the account

This approach ensures you’re only rewarding genuine, non-fraudulent conversions.

Coupon Code Restrictions

If rewards are issued as discounts or store credit via coupon codes:

- Make codes single-use only to prevent reuse

- Tie coupon codes to specific accounts (non-transferable)

- Limit redemptions to one code per customer lifetime

- Require a minimum spend threshold to activate the code

Technology & Automation

Choosing the Right Referral Platform

Not all Shopify referral apps offer the same level of fraud detection. When evaluating tools, prioritize:

- IP tracking and geolocation to flag suspicious patterns

- Device fingerprinting to detect multi-account abuse from the same browser

- Behavioral analysis to spot anomalies in real-time

- Automated flagging rules that trigger manual review or block suspicious claims

- Shopify native integration for seamless order and customer data access

Automation Triggers

Set up automated alerts for:

- More than $50 earned by a single account in one week

- More than 3 referral claims from the same IP in 24 hours

- Referral completion rates above 80% (legitimate rates are typically 5–20%)

- Accounts with multiple payment methods or addresses linked

- Referral activities from known VPN or proxy IP ranges

These automated flags feed into a manual review queue, reducing false positives while catching high-risk activity.

Explicit Program Rules & Policy Communication

Clear Terms and Conditions

Your referral program’s T&Cs must explicitly state:

- “Self-referrals, account fraud, and multi-accounting are strictly prohibited.”

- “Violators will have their accounts permanently banned and rewards forfeited.”

- “We reserve the right to audit accounts and referral activity at any time.”

- “Suspicious activity will be investigated before any reward is issued.”

Post these terms prominently on your referral page, in program emails, and on your FAQ.

Ongoing Policy Updates

As new fraud tactics emerge, update your T&Cs proactively. Communicate changes to your customer community via email or in-app notifications to set clear expectations and discourage would-be fraudsters.

Manual Monitoring & Transaction Auditing

Automation is powerful, but human review remains essential. Establish a weekly or bi-weekly audit process:

- Export flagged referrals from your referral platform

- Spot-check high-risk patterns:

- Multiple accounts from the same address or IP

- Unusually high rewards earned in short timeframes

- Referral conversion patterns that deviate from historical norms

- Maintain a blocklist of known or suspected fraudsters and their associated email addresses, IPs, and payment methods

- Document decisions for future pattern recognition and training

This hybrid approach—automation + human judgment—catches edge cases that pure algorithmic detection misses.

Behavioral Analysis & Machine Learning

For larger Shopify stores, behavioral analytics platforms can identify fraud with high precision:

- Cohort analysis: Compare the behavior of top referrers to average referrers. Legitimate high performers show consistent brand engagement, repeat purchases, and social sharing. Fraudsters show only reward-claim activity.

- Anomaly detection: Flag sudden spikes in referral volume, geographic inconsistencies, or clusters of referrals from related accounts.

- Fraud scoring: Assign a risk score (0–100) to each referral based on multiple signals. Claims above a threshold trigger manual review or denial.

Recommended Shopify Referral Fraud Prevention Tools

Below is a comparison of leading Shopify referral apps evaluated on fraud-prevention capabilities:

| App/Tool | IP Tracking | Manual Review Queue | Reward Delays | Shopify Native | Unique Features | Price Range |

| Bloop Referrals & Affiliates | Yes | Yes | Yes | Yes | Flexible rewards, auto fraud prevention | Free – $49.99 |

| Yotpo Loyalty | Yes | Yes | Yes | Yes | Minimum spend threshold; tier-based rewards | Free–$799/mo |

| Talkable | Yes | Yes | Yes | Yes | Flexible fraud rules; custom workflows | $59/ month(3% of referral revenue after reaching $2,000 in referral revenue per month) |

| Rivo Loyalty | Yes | Yes | Yes | Yes | Blocklist management; exclusion rules | Free–$499/mo |

| ReferralCandy | Yes | Manual only | Limited | Yes | Multi-channel referral; easy setup | $29–$799/mo |

Self-referral fraud prevention roadmap

Self-referral fraud is manageable—but only with a structured, multi-layered approach. The strategies outlined in this guide move you from reactive (discovering fraud after it occurs) to proactive (preventing it before it impacts your program). Here’s your Step-by-Step Implementation Plan

Phase 1: Assessment (Week 1)

- Audit your current referral program: How many accounts exist? What’s your approval rate? Are there visible fraud patterns?

- Document your current verification, throttling, and monitoring processes

- Calculate your estimated fraud loss (flagged but unreviewed referrals, chargebacks, etc.)

Phase 2: Technology Selection (Week 2–3)

- Evaluate Shopify referral apps using the comparison table above

- Select a tool that matches your store size and fraud profile

- Test the tool in a staging environment before production rollout

Phase 3: Policy & Rule Setup (Week 3–4)

- Finalize your referral T&Cs with explicit fraud prohibitions

- Configure reward caps, fulfillment-based issuance, and coupon restrictions

- Set automated fraud flags and manual review triggers

Phase 4: Team Training & Communication (Week 4–5)

- Train your team on the new fraud detection workflow

- Communicate policy updates to your customer community

- Create FAQ and help documentation for customers

Phase 5: Monitoring & Optimization (Ongoing)

- Monitor flagged referrals weekly; establish a 24–48-hour review SLA

- Track fraud rate, false-positive rate, and legitimate referral approval rate

- Quarterly audits to refine rules based on observed patterns

- Celebrate and spotlight legitimate top advocates to build community trust

Ready to Secure Your Referral Program?

Self-referral fraud is a known problem with proven solutions. By implementing these prevention strategies—verification layers, transaction controls, smart automation, and ongoing monitoring—you’ll protect your program ROI, maintain data integrity, and build a thriving community of legitimate advocates.

Bloop helps Shopify merchants of all sizes supercharge referral and affiliates programs—while keeping them safe from fraud. Get started with a Shopify referral fraud audit or a personalized fraud-prevention consultation to uncover vulnerabilities and implement a tailored defense strategy today.

>> Contact us now!